Do More With Clevero For

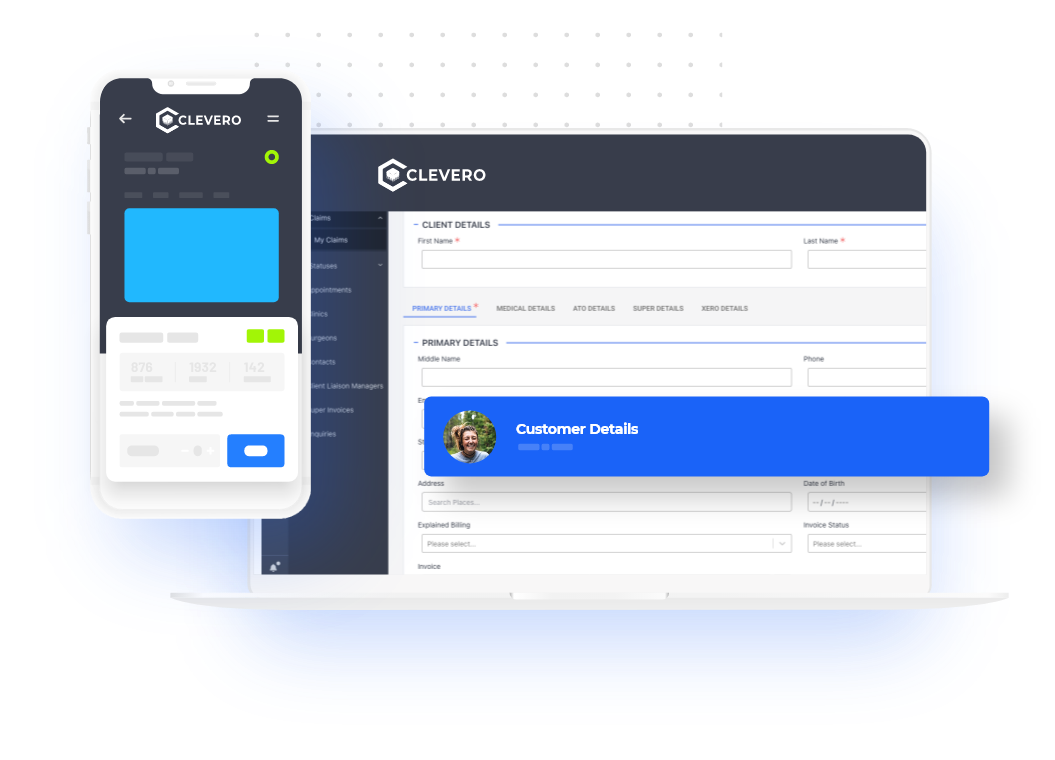

A customisable platform that provides everything you need to run your Invoicing, Accounting or Bookkeeping in one place.

Simply connect Clevero to your preferred accounting software to view, edit and report on all aspects of your business’s bookkeeping or accounting. Sync tracking categories such as:

Forget spreadsheets and paper trails. Operational staff can do it all inside Clevero without having to leave the platform.

No matter your process or how you want to work, Clevero has you covered. On one dashboard, view projects with no invoice, or jobs with unpaid or paid invoices without needing to leave your CRM.

Never miss an invoice! Automate your unnecessary manual data entry so your team can get back to work.

Clevero connects all your other business tools together to create a seamless technology stack

Contact us now for a FREE online consultation to explore how we can support your business to streamline, automate and unleash its growth potential!

For Australian accounting and bookkeeping firms, handling client demands, compliance deadlines, and admin tasks can quickly become time-consuming without the right systems. Many rely on a mix of disconnected tools, like spreadsheets for tracking and separate systems for documents, plus email for client communication. This combination leads to double-handling, slows workflows, and makes it harder to keep client work on track.

Instead of juggling spreadsheets, email threads, and multiple apps, accounting teams can centralize tasks, documents, and client info in one spot using modern practice management tools. This reduces friction, which often leads to inefficiencies, missed details and extra admin for your team.

With an integrated system, client information becomes instantly accessible, and your team is clear on what to do and when—without searching through inboxes or shared drives. This is exactly what integrated accounting practice management software is built to provide. It offers clarity, control, and much-needed breathing room in daily operations.

This article simplifies the jargon and explains how an integrated practice management system helps Australian firms. It automates client onboarding and workflow steps while improving visibility, cutting admin tasks, and keeping your team aligned. The sections below break down the core benefits, key features and how it adapts to your processes, helping you deliver smoother client service with less effort.

Accounting practice management software is a system that centralizes and automates operations in accounting or bookkeeping firms. It combines client data, workflows, tasks, documents, and communications into one platform. This eliminates the need to switch between spreadsheets, shared drives and different apps

With everything in one spot, firms can manage client relationships, track progress, organize documents, and handle admin tasks more efficiently. This reduces double-handling, improves visibility across jobs, keeps teams aligned, and helps prevent important steps from being missed

In short, an integrated platform offers a clear, real-time view of your entire practice, helping you stay on top of work across the entire practice

Takeaway: Integrated practice management software centralizes operations, cuts administrative work, and provides better visibility for your accounting or bookkeeping practice.

Accounting practice management software focuses on your firm’s day-to-day operations. In contrast, standard accounting software like Xero or MYOB handles client transactions and financial record-keeping. Practice management tools help you oversee internal processes, client relationships, job workflows, team tasks and document storage—all the operational work that sits outside the ledger.

Rather than replacing Xero or MYOB, practice management software works alongside them to keep your practice organised, reduce admin and give you a clear view of work in progress. By centralising information and standardising workflows, your team delivers client work more consistently while your accounting system manages bookkeeping and tax calculations.

Takeaway: Practice management software manages your firm’s operations, while accounting software manages client financials—each plays a different role, and they work best when used together.

Accounting practice management software tackles key issues for Australian firms. These include disconnected systems, slow manual processes, and limited visibility into client work. Instead of juggling spreadsheets, emails, and separate job trackers, teams can use one platform. This approach reduces duplication, saves time and helps prevent missed steps.

By automating routine tasks—like sending reminders, requesting documents, or following up with clients—staff can focus on more valuable work. It also offers real-time insights into workloads, deadlines, and job progress. This gives partners and managers better visibility to plan workloads, prioritise jobs and stay ahead of deadlines.

With a centralised system, firms provide smoother client service, reduce errors, and create a more organised and efficient workflow for your team.

Takeaway: Integrated practice management software addresses common challenges like disconnected tools and manual processes. It gives Australian firms better visibility and control over their operations.

Accounting practice management software makes client onboarding easier. It automates data collection, document requests, and welcome sequences. Firms can use secure client portals instead of scattered emails. This centralises client information, documents and communication in one location. It also reduces the risk of missed messages and keeps communication organised.

Standardized templates, automated reminders, and consistent workflows ensure clients get timely updates. Clients know what they need to provide and when. This speeds up onboarding, cuts down on back-and-forth questions, and reduces admin for your team.

From the start, your team spends less time chasing information and more time adding value.

Takeaway: Automated processes and secure client portals speed up onboarding and communication. This creates a more organised and efficient client experience.

Yes, accounting practice management software can automate many admin tasks. This reduces repetitive data entry and routine admin. It can automatically assign tasks based on service type. It also sends reminders for missing information, generates recurring invoices, and standardizes document requests.

By using rules, templates, and consistent workflows, the system handles these repetitive tasks in the background. Your team won't have to chase or re-enter information. This reduces double-handling, improves accuracy, and keeps tasks moving on schedule, even during busy periods.

As a result, your team has more time for complex client work and higher-value tasks that require expertise and client focus.

Takeaway: Use automation to get rid of repetitive admin tasks. This frees your team for work that needs expertise, not just data entry.